A Comprehensive Guide to the Mortgage Process

Let’s Start with a Loan: Your Comprehensive Guide to the Mortgage Process

Congratulations on taking the first step toward homeownership! Securing a mortgage is a crucial part of the homebuying journey, and understanding how it works can empower you to make informed decisions. This guide will demystify the mortgage process, from pre-approval to closing, providing valuable insights and tips to help you navigate the journey with confidence.

Understanding Your Financial Situation

Before diving into mortgage shopping, it’s essential to assess your financial situation. Start by calculating your budget, taking into account your income, monthly expenses, and savings.

Evaluate Your Creditworthiness

Next, evaluate your credit score and credit history. Lenders use these metrics to assess the risk of lending to you, so knowing your score upfront can help you anticipate the type of mortgage for which you may qualify.

Determine Your Borrowing Capacity

Finally, determine how much you can afford to borrow and what monthly mortgage payments fit within your budget. This is key to ensuring you don’t stretch your finances too thin.

Mortgage Pre-Approval

Getting pre-approved for a mortgage is a pivotal step in the homebuying process. It shows sellers that you are a serious buyer with the financial means to purchase a home.

The Pre-Approval Process

To get pre-approved, you’ll need to provide documentation such as proof of income, employment verification, bank statements, and details about your assets and debts. The lender will review this information along with your credit history to determine your maximum loan amount.

Being pre-approved not only gives you a competitive edge when making an offer but also streamlines the mortgage process once you find the right property.

Choosing the Right Mortgage

With numerous mortgage options available, selecting the right one for your needs can feel overwhelming. Here’s an overview of common types of mortgages:

- Fixed-Rate Mortgage: Offers a stable interest rate and predictable monthly payments throughout the loan term.

- Adjustable-Rate Mortgage (ARM): Features an initial fixed-rate period followed by periodic adjustments based on market conditions.

- FHA Loan: Insured by the Federal Housing Administration, this option offers low down payment requirements for qualified buyers.

- VA Loan: Available to eligible veterans, active-duty service members, and their spouses, featuring favorable terms and no down payment requirement.

- USDA Loan: Backed by the U.S. Department of Agriculture, designed for homebuyers in rural and suburban areas with low to moderate incomes.

Consider factors such as your financial situation, long-term goals, and risk tolerance when choosing the right mortgage.

Applying for a Mortgage

Once you’ve selected a lender and loan type, it’s time to apply. The mortgage application process involves providing detailed information about your finances, employment history, and assets and debts.

What to Prepare

Prepare to submit documentation such as pay stubs, tax returns, bank statements, and proof of identity. Be ready to answer questions about your credit history and employment status. The more organized and thorough you are, the smoother the application process will be.

Underwriting and Approval

After submitting your application, the lender will begin the underwriting process. During underwriting, the lender reviews your financial information, verifies the accuracy of your documents, and assesses your eligibility for the loan.

What Happens During Underwriting?

This process may include evaluating your credit score, debt-to-income ratio, employment history, and the property’s appraisal value. The underwriter may request additional documentation or clarification on certain aspects of your application. Once satisfied with your financial profile and the property’s compliance with lender requirements, you’ll receive final loan approval.

Closing the Loan

Congratulations! You’ve been approved for a mortgage! Now it’s time to close the loan and finalize your home purchase.

What to Expect at Closing

The closing process involves signing various legal documents, including the mortgage note, deed of trust, and closing disclosure. You’ll also pay closing costs, which may include fees for loan origination, appraisal, title insurance, and prepaid property taxes and insurance.

The closing agent will facilitate the transfer of funds and ownership of the property from the seller to you. Once all documents are signed and funds disbursed, you’ll receive the keys to your new home!

Managing Your Mortgage

After purchasing your home, it’s crucial to manage your mortgage responsibly to avoid financial hardship.

Tips for Responsible Mortgage Management

Make Payments on Time: Timely payments help maintain good credit and avoid late fees.

Review Your Mortgage Statement: Regularly check for accuracy and identify potential issues.

Explore Refinancing Options: If your financial situation changes or interest rates drop, consider refinancing or modifying your loan.

Make Extra Payments: Consider making additional payments toward your principal to pay off your mortgage early and build equity in your home.

By managing your mortgage effectively, you can protect your investment and achieve long-term financial stability.

Let’s Get You Set Up!

Navigating the mortgage process can be complex, but with the right knowledge and guidance, you can successfully secure a loan and turn your homeownership dreams into reality. By understanding your financial situation, getting pre-approved, choosing the right mortgage, applying for the loan, navigating underwriting, closing the loan, and managing your mortgage responsibly, you’ll be well-equipped for this journey.

Remember, you’re not alone! Your mortgage lender and real estate agent are invaluable resources who can assist you every step of the way. Happy house hunting!

Let’s start with a loan.

Congratulations on taking the first step towards homeownership! Securing a mortgage is a crucial part of the homebuying process, and understanding how it works can help you make informed decisions and achieve your homeownership goals. In this comprehensive guide, we'll demystify the mortgage process, from pre-approval to closing, providing valuable insights and tips to help you navigate the journey with confidence.

Understanding Your Financial Situation

Before you start shopping for a mortgage, it's essential to assess your financial situation. Begin by calculating your budget, considering your income, monthly expenses, and savings. Evaluate your credit score and credit history to understand your creditworthiness. Lenders use credit scores to assess the risk of lending to you, so knowing your score upfront can help you anticipate the type of mortgage you may qualify for. Finally, determine how much you can afford to borrow and what monthly mortgage payments fit within your budget.

Mortgage Pre-Approval

Getting pre-approved for a mortgage is a crucial step in the homebuying process. Pre-approval demonstrates to sellers that you are a serious buyer and have the financial means to purchase a home. To get pre-approved, you'll need to provide documentation such as proof of income, employment verification, bank statements, and information about your assets and debts. The lender will review your financial information and credit history to determine the maximum loan amount you qualify for. Being pre-approved can give you a competitive edge when making an offer on a home and helps streamline the mortgage process once you find the right property.

Choosing the Right Mortgage

With various types of mortgages available, choosing the right one for your needs can be challenging. Here's an overview of the most common types of mortgages:

Fixed-Rate Mortgage: Offers a stable interest rate and predictable monthly payments over the life of the loan.

Adjustable-Rate Mortgage (ARM): Features an initial fixed-rate period followed by periodic adjustments based on market conditions.

FHA Loan: Insured by the Federal Housing Administration and offers low down payment options for qualified buyers.

VA Loan: Available to eligible veterans, active-duty service members, and their spouses, with favorable terms and no down payment requirement.

LINKS TO OTHER BLOG ARTICLES

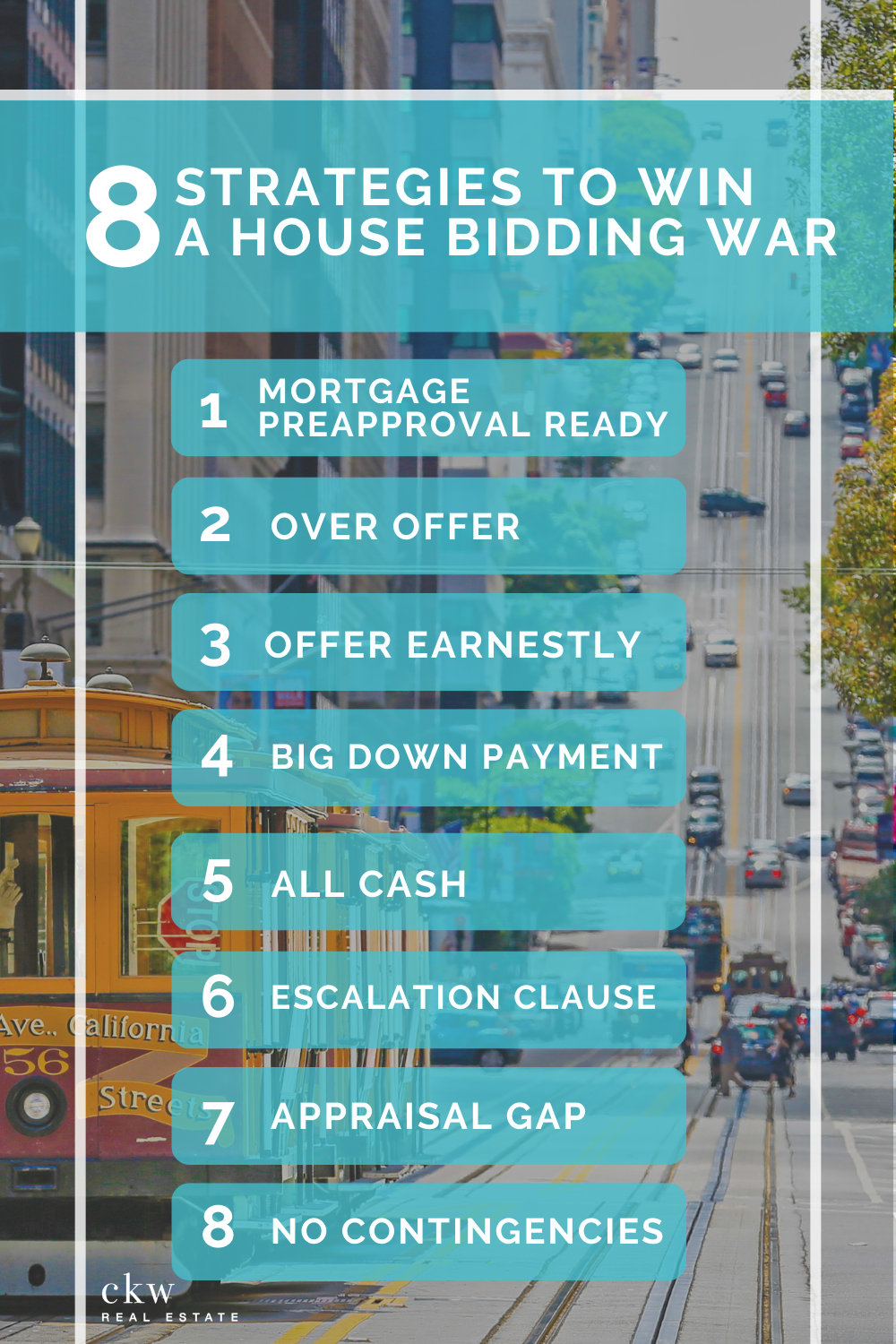

8 STRATEGIES TO WIN A HOUSE BIDDING WAR

QUICK GUIDE TO BUYING A HOUSE IN SAN FRANCISCO

THINGS YOU CAN DO WHILE QUARANTINED AT HOME

HOW TO BUY A HOME DURING COVID-19

GOVERNOR GAVIN NEWSOM’S EXECUTIVE ORDER EFFECTS ON REAL ESTATE

TO BUY OR NOT TO BUY IN SAN FRANCISCO DURING SHELTER-IN-PLACE

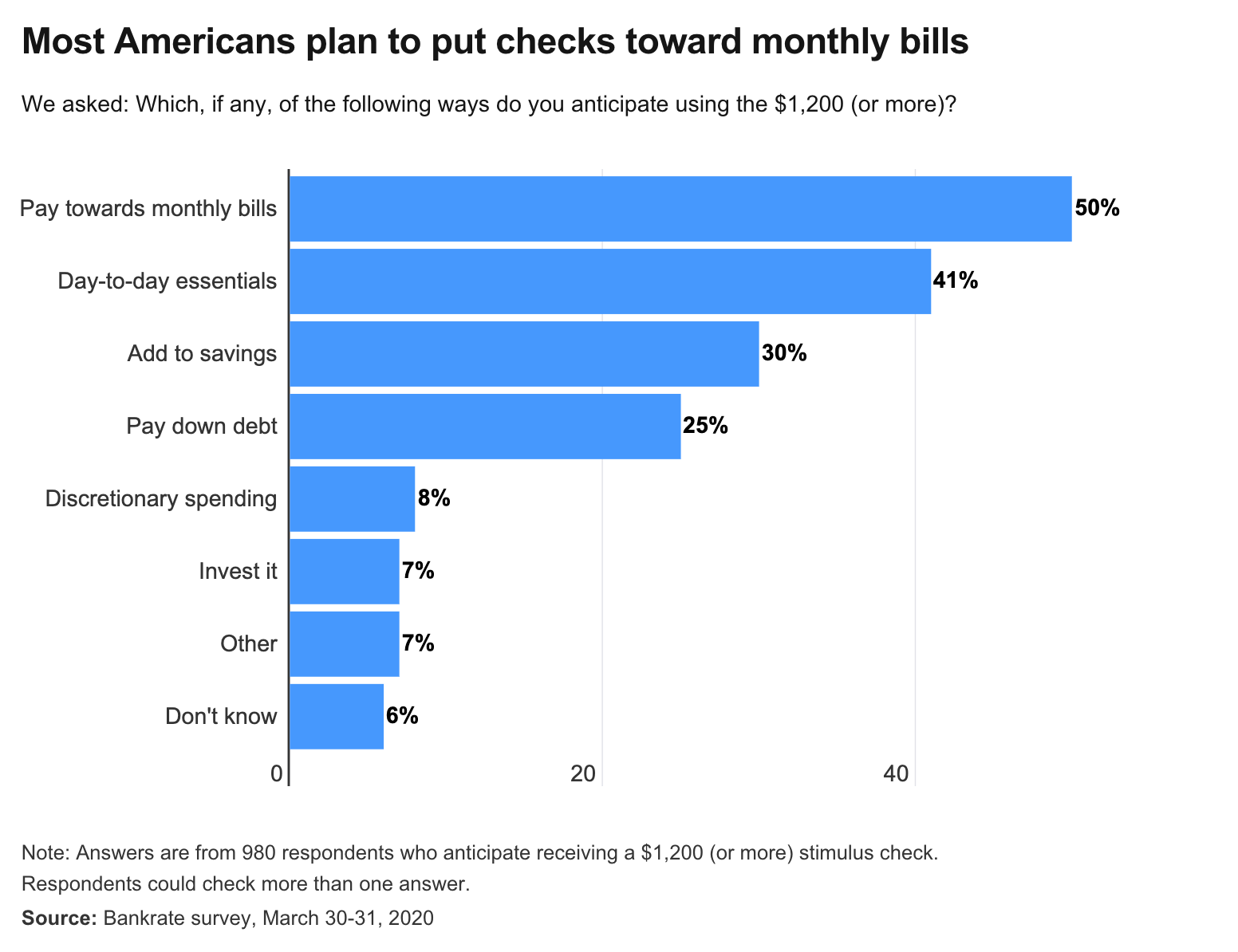

WHAT THE CARES ACT MEANS FOR YOU (CORONAVIRUS AID, RELIEF AND ECONOMIC SECURITY ACT)

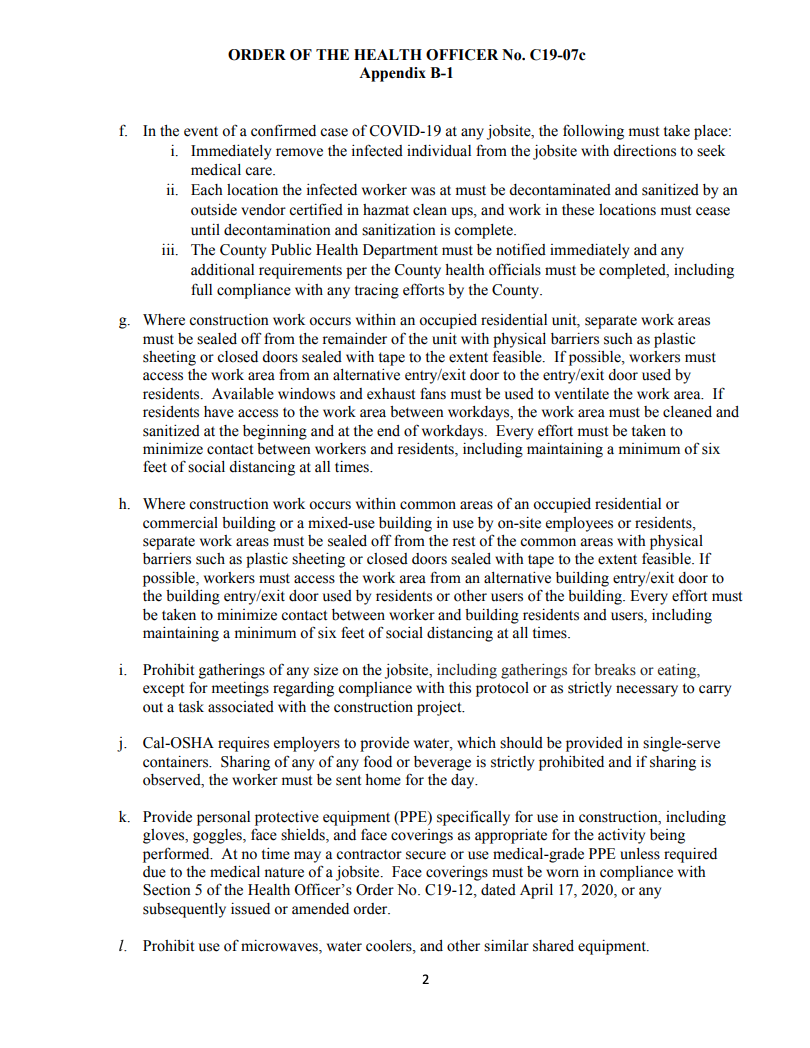

CONSTRUCTION UPDATES FOR SHELTER-IN-PLACE

CONFIRMING WITH THE IRS WHERE TO SEND YOUR STIMULUS $$$

SAN FRANCISCO: IS NOW A GOOD TIME TO SELL A HOUSE?

HOW SAN FRANCISCO REAL ESTATE GOT SO EXPENSIVE AND WHY SF REAL ESTATE VALUES HOLD

HOW TO CHOOSE A REALTOR TO SELL YOUR INVESTMENT PROPERTY IN SAN FRANCISCO: 5 ESSENTIAL TIPS

PROP 19 PROPERTY TAX CHANGES & ACTIONS TO TAKE

COMMERCIAL REAL ESTATE PROS + CONS