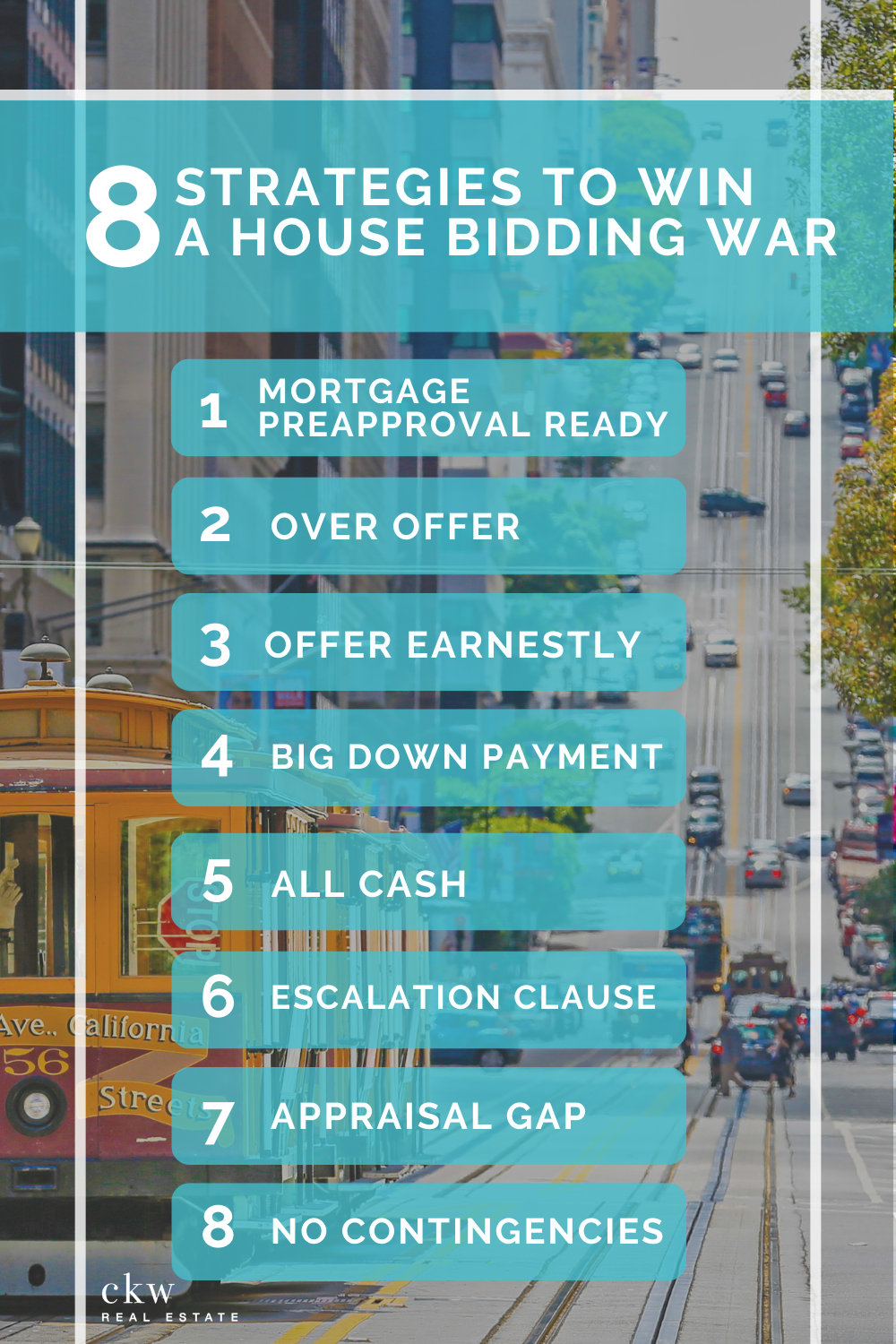

8 Strategies to Win a House Bidding War

You've finally found your dream home, you can even imagine yourself lounging in the living room and cooking in the kitchen... There's just one problem, especially in a competitive housing market. Your dream home could also be the perfect home for several other people, all who are looking to secure your dream home for themselves.

Just because there are other interested buyers standing between you and your dream house, doesn't make it an impossible task. Instead of just turning around and walking away from the perfect place you can see yourself settling down in, consider these 8 strategies to hopefully emerge the winner against competing offers in a house bidding war.

Get preapproved for a mortgage

Purchasing a home isn't something you do on a whim, and sellers expect that you would already have your finances in order before you even begin your house hunt. First consulting with a lender, discussing your financing options, and attaining a preapproval letter, will give sellers more confidence in you as a potential buyer.

It is important to note that a preapproval letter is different from a prequalification letter! A prequalification letter is only the initial step in a financing process, where a lender believes you "qualify" for a loan simply based on your personal finances.

Preapprovals, however, involve an intensive examination of your credit score, ongoing income, assets and liabilities, income tax contributions and more. Then only will the lender offer a conditional commitment to loan you a certain amount of money for a mortgage.

Knowing that you come with a "preapproved" financial profile can only help sellers feel more at ease to sell you their property, knowing that you won't run into trouble financing the full payment. It also means they'll be able to close on the house more quickly, since your mortgage plan is already "in the bag", so to speak.

2. Over Offer

Let's face it, money talks. This is especially true when you're trying to purchase a home in a sellers market. If there are many interested buyers, sellers are naturally going to look at who is offering more money for their house. It isn't an automatic auction process where the highest bidder wins, but you can't ignore the fact that the more money you offer, the more likely they'll consider you as a viable option.

If you really want this house and you're pretty sure you can't imagine living anywhere else, chances are you'll be willing to put in a higher offer than the seller's list price in order to coax them to sell it to you, and not anyone else. Over offering is extremely likely in a sellers market with bidding wars going on, simply because a seller isn't going to accept less out of "compassion" when they can walk away with a greater profit.

3. Offer earnestly

Besides offering more than the asking price, you can also hope to secure your dream house by offering more in terms of earnest money deposits.

The earnest money deposit (or good faith deposit) is what it sounds like - money you place as a deposit because you are earnest, or serious, about purchasing a seller's home. Because all sellers take a risk-taking their house off the property market, the earnest money deposit is there to protect their risk in case you change your mind unexpectedly. In other words, the earnest money deposit is your skin in the game as a potential buyer.

Although the earnest money deposit goes into an escrow account and usually goes towards a down payment or closing costs, it is definitely separate from the down payment you make towards home financing.

The earnest money deposit signifies your serious intent in purchasing a seller's property, so offering more may convince the seller that you're confident their property is indeed your dream home, and that you're not changing your mind at any point.

4. Go big on your down payment

It's simple math - the more you put down as your down payment, the less financing you'll need from a lender. While you may be pre approved for financing and everything looks great on paper, sellers are naturally going to worry if your financing might hit a snag in future. A greater down payment means more confirmed cash already in the pocket, which serves as a strong assurance to sellers.

This can make a big difference even if another potential buyer puts in an offer price that's higher than yours - if you're offering a greater down payment, you might have an edge over their overall offer. These are definitely things sellers will take note of when considering multiple offers, so it's not automatic that the highest offer always wins.

5. Throw cash at it

Of course, this probably isn't going to be feasible for most of us, but if you can, making a cash offer on your dream house will definitely show the seller that you're serious about it! It'll also make your offer stand out amongst other potential buyers in a competitive market. When you pay cash, it takes the risk of financing out of the picture, and sellers would be more likely to consider you seriously. Some sellers will also opt for the convenience and efficiency of a quick cash closing process over a higher, but mortgaged, offer.

6. Write an escalation clause

Because bidding wars are somewhat auction-like in nature, you're always going to be trying to outdo someone else's bid. By writing an escalation clause into your offer, you are already preempting the eventuality that you do get outbid, and already offering a possible counter bid up front. You could also insert a cap price, which is the maximum price you're willing to offer on the property. However, the risk of doing this is that the seller might not come back to you to ask for a "best and final'', if the bidding war has already pushed the current purchase price above your stated cap price.

7. Address the appraisal gap

If you are purchasing this house on a loan, your lender will conduct an appraisal to check the property's market value. If the appraisal comes back with an amount that's lower than your offer, that's going to be pretty disappointing, because it means you won't be financed for the full amount you offered. Will you have the cash on hand to make up for the difference between the appraised value and your offer price?

It's going to be disappointing to the seller too, if it means they might not be getting your full offer that you made, if you were 100% relying on financing to purchase the house. However, if you first include an appraisal gap guarantee in your offer, which means you'll be willing to pay any difference between the appraised price and your offer in cash, any seller will feel more convinced and secured in their decision to pick you as the buyer.

8. Forgo certain contingencies

Buyers sometimes want to include certain stipulations in their offer, and these are usually to protect them, or to make the situation easier for them to complete the purchase. In many cases, a common contingency prospective buyers like to include is the "home sale contingency" which states that their existing home has to sell first, before they can purchase the seller's property.

If you place yourself in the shoes of a seller, would you want to wait for someone else's home to sell first before you can sell yours, or would you like to get your sale closed as soon as possible?

That's why as a potential buyer, if you can afford to waive certain contingencies such as the aforementioned home sale contingency, or others like home inspection contingency, or financing contingency, that flexibility gives you an edge in the bidding war because it makes things so much easier for the seller, and they'll be more willing to sell their property to you.

(Just a note of warning: Do not waive the home inspection contingency if inspecting the property's condition inside and out before you buy is of utmost importance to you!)

The above 8 strategies are ways that you can pull ahead of your competition in any real estate bidding war, but do it carefully, and always with the guidance of a licensed real estate agent. Remember, you're probably doing this for the first, if not second or third time, whereas real estate agents have had the advantage of having successfully guided their prior clients through probably hundreds of bidding wars. Good luck and all the best securing your dream home!

LINKS TO OTHER BLOG ARTICLES

QUICK GUIDE TO BUYING A HOUSE IN SAN FRANCISCO

THINGS YOU CAN DO WHILE QUARANTINED AT HOME

HOW TO BUY A HOME DURING COVID-19

GOVERNOR GAVIN NEWSOM’S EXECUTIVE ORDER EFFECTS ON REAL ESTATE

TO BUY OR NOT TO BUY IN SAN FRANCISCO DURING SHELTER-IN-PLACE

WHAT THE CARES ACT MEANS FOR YOU (CORONAVIRUS AID, RELIEF AND ECONOMIC SECURITY ACT)

CONSTRUCTION UPDATES FOR SHELTER-IN-PLACE

CONFIRMING WITH THE IRS WHERE TO SEND YOUR STIMULUS $$$

SAN FRANCISCO: IS NOW A GOOD TIME TO SELL A HOUSE?

HOW SAN FRANCISCO REAL ESTATE GOT SO EXPENSIVE AND WHY SF REAL ESTATE VALUES HOLD

HOW TO CHOOSE A REALTOR TO SELL YOUR INVESTMENT PROPERTY IN SAN FRANCISCO: 5 ESSENTIAL TIPS

PROP 19 PROPERTY TAX CHANGES & ACTIONS TO TAKE

COMMERCIAL REAL ESTATE PROS + CONS

TOP 10 BOOMING SMALL CITY REAL ESTATE MARKETS 2021

ABOUT CRYSTLE

As the CEO of a San Francisco-founded, global tech startup, Crystle understands from experience what it takes to succeed. Her real estate experience spans from successfully managing multiple properties over the last 10+ years including residential, commercial, and mixed-use, as well as her time spent actively investing in flipping properties, tax liens, tax deeds, and other property types. As a native-born and raised in San Francisco, you can trust that you’re in the good hands of a local who can help you navigate the micro-neighborhoods of San Francisco. Crystle invests in relationships and you can count on her to walk with you through the process of buying or selling your property.

You might ask yourself, “What does a tech startup have to do with real estate?”

Good question! Everything about Crystle exudes intention. Her ultimate goal is to grow her tech company so that she can utilize its philanthropic arm to fund micro-housing for the homeless in partnership with key, long-standing, and successful social services organizations in San Francisco. Real Estate gives her the ability to network and learn about developing land to purchase in the future to develop micro-housing. Her time serving on boards for these nonprofits gives her the knowledge of what these organizations really need to be able to get more people off the streets for good.

HER CURRENT FOCUS WITH REAL ESTATE CLIENTS IS TO WORK AND PARTNER WITH CHURCHES, NONPROFITS, AND AFFORDABLE HOUSING DEVELOPERS.

The same cornerstones that drive success in her tech company are the same cornerstones that make her the best real estate agent to work with: honesty, transparency, integrity, and a relationship-focused mindset toward life.

Crystle was born and raised in San Francisco’s Inner Richmond district and continues to choose to establish her future life in San Francisco as well. She is a woman of her word. She not only financially supports several not-for-profits, but also regularly serves in her community helping the homeless, youth, and those in poverty.

In her spare time, she is an active and current member of the Board of Directors of Lutheran Social Services of Northern California, the APA Heritage Foundation Committee of San Francisco, Board Member of Old Skool Cafe, and volunteer with Mobilize Love. She has previously and faithfully served on the Board of Directors for Zion Lutheran Church and School of San Francisco, the Board of Directors for Designing a Difference, the Board of Directors for APAPA San Francisco, a member of the Friends of Smuin Ballet, and as a Co-Chair for the Princess Project.